Food e-commerce in Nigeria

The rise and prospects of the industry

It’s a panoramic and while some businesses have failed, many have risen. Food is connected to the ideals of what makes us human - survival. It is one of the constant things in our lives. We eat every day. Before the pandemic, there were so many options to get your next meal. As the pandemic hit, some of these options became more prominent due to the need to social-distance and stay at home. One of the booming industries in Nigeria right now is the food industry, especially the food e-commerce industry. Let’s unpack what is going on here.

How food e-commerce works

To understand how food e-commerce works, we need to understand how e-commerce works as a business model. E-commerce allows buyers to get access to the products they want from the comfort of their devices - smartphones, laptops, or anything with access to the internet. What the user sees is a website with a ton of products they are able to choose from. Once they complete checkout, they are expecting the product to arrive at their doorstep on the agreed date. To make that “simple” process happen, there are a lot of things going on in the background that the buyer is not privy to. This includes but not limited to: tech infrastructure (hosting, payments, etc.), stocking, warehousing, last-mile delivery logistics.

Food e-commerce is not so different. The main difference? In other types of e-commerce, same-day delivery is a privilege. Amazon charges a premium through Prime to provide that. With food e-commerce, same-day delivery is too late. Your consumer wants their food in the next hour or less. Even though there are smaller food vendors who do next-day delivery to manage expectations, people order food when they are hungry ideally. This singular fact changes the dynamic with food e-commerce when you compare it with other e-commerce types. Food e-commerce comes in different forms. A big part of this is their fulfillment models and how they mirror other e-commerce models.

The food ecosystem, simplified

Who are the players?

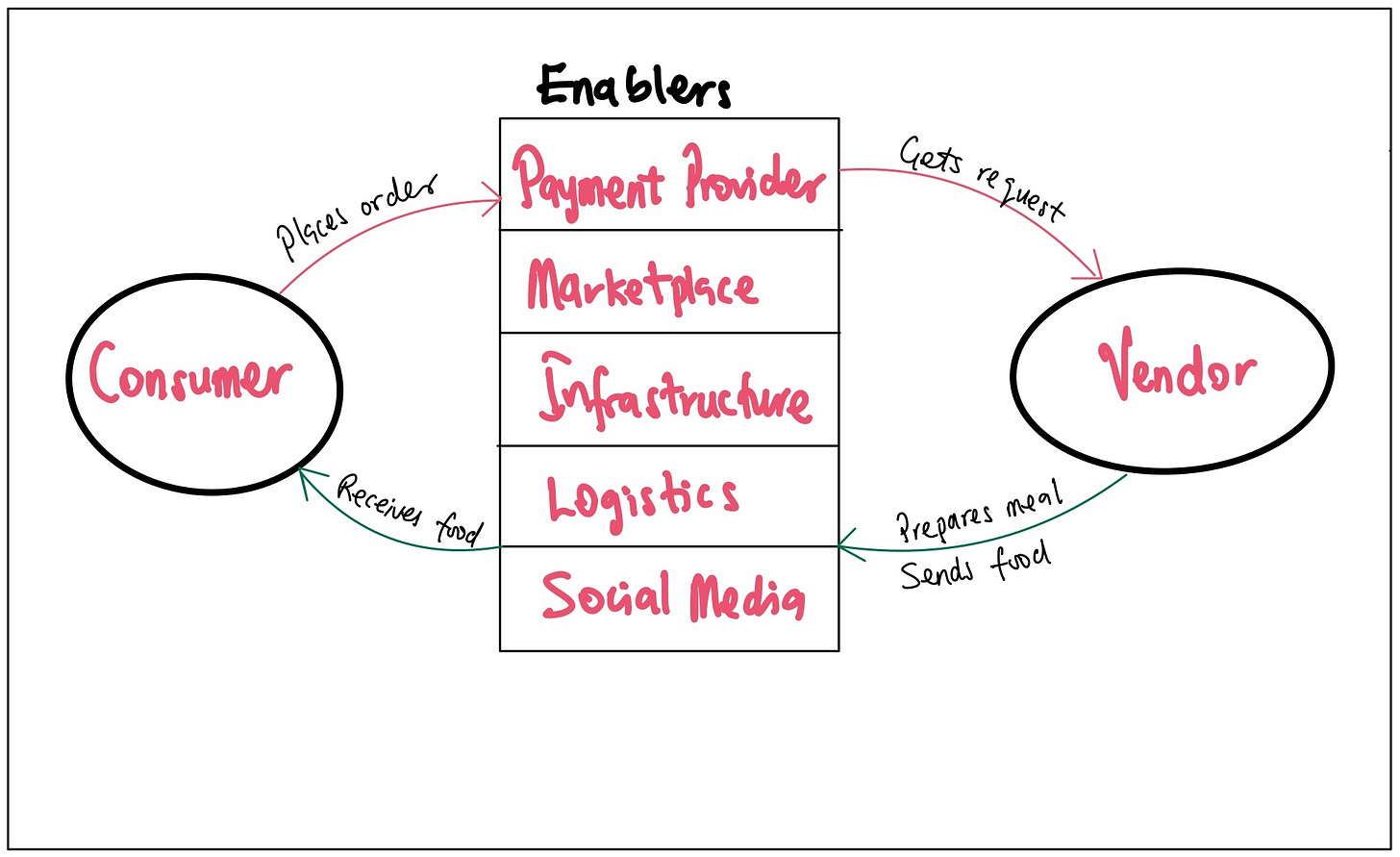

To make the explanation easier, we can identify the key players in the food e-commerce ecosystem as: the vendors, the enablers and the consumers

The vendors are the backbone of the food business at large. They make the food. Largely, there are two types of vendors - the brick-and-mortar restaurants and the online vendors. For brick-and-mortar restaurants, online selling is a backup plan and not the main driver of their businesses. In fact, most of them did not have an option for online delivery until the pandemic hit. Online vendors live and breathe the internet. That is their major only source of revenue. While restaurants can get away with logistics mishaps, for online vendors that is their bread and butter. They have to get it right and that is increasingly hard in a country like Nigeria or even a state like Lagos.

The enablers on the other hand are the backbone of food e-commerce. They make the engine that is online delivery run smoothly. In this category, you have tech infrastructure like Buyfood.Africa. Recently launched, Buyfood provides a platform for food vendors and restaurants alike to build their own food ordering website. Ni fries was built on the Buyfood platform. Think Shopify but for food vendors. We also have marketplaces like Jumia Food. Marketplaces allow food vendors to reach consumers. They list the products on their website/app and coordinate the logistics, payments, etc. Think Uber but for food vendors (sounds like Uber Eats :D). A key part of all of these is the last-mile logistics firms like Gokada helping food vendors reach their customers in time. Social media also falls in the enabler category allowing some food vendors to set up shop and reach customers without necessarily using building out their own infrastructure or working with a marketplace.

The consumers are us. We eat the food.

The rise of food e-commerce in Nigeria

When the lockdowns came looming, everyone rushed to buy toilet papers. Why? Because they need to prepare for the consequences of eating different kinds of food that won’t necessarily be homemade. Okay. I kid. I kid. Toilet paper shortage at the start of the pandemic is not in any way linked to food e-commerce.

With stay-at-home orders across the world, many started turning to food delivery services to feed their stomachs. This has given rise to a number of food e-commerce companies. Even on social media, we see an uptick in the number of food vendors advertising their services. Let’s take a step back. We can trace the history of this industry back to 2012 when e-commerce started in Nigeria. Konga and Jumia came into the market to set the stage for what will be the next tech revolution in the country. They came at a time when there was no structure in place for these kinds of businesses. They had to figure out their own payment infrastructure (KongaPay, JumiaPay), logistics (KOS delivery etc.) amongst other things. There was basically nothing for e-commerce to thrive upon in Nigeria back then. Zilch!

Logistics as a service didn’t quite pick up immediately. Even though it was the backbone of these businesses, it still stood in the shadows while things like payments (read: Fintech!) shone. However, at the beginning of 2020, we saw a rise in the number of dispatch riders on the roads. The Lagos State government had just banned passenger motorcycles and most of the businesses in this industry pivoted to last-mile logistics. Food logistics was one of the key drivers of growth in this area. Gokada, one of the prominent ride-hailing startups in Lagos, partnered with Jumia Food to facilitate food delivery in February of 2020. They also provided logistics service to a number of food vendors, including a food subscription service (Eden). This switch in business model happened just before the pandemic which accelerated food delivery services even further. Gokada later went on to launch its own food e-commerce product (GShop) in September.

The pandemic did not just change the way people buy food online, it also affected how vendors like restaurants operate. We saw droves of restaurants that didn’t offer online delivery in the past setting up shop on Jumia Food or starting their own online delivery structure.

How can we tell food is big? New players are coming into the market. Bolt recently indicated that Bolt Food is coming to Nigeria. They see an opportunity and they are coming for it. In October of last year, Gokada also launched GShop - a food marketplace that runs on their last-mile logistics service. They could’ve launched a shoe delivery service but must have seen how big food delivery is as a part of their logistics business. Even some businesses that do more than food are paying closer attention to food. Eden was created to help people automate chores including cooking. However, in the past year, they have consistently focused on the food side of the business. Scroll through their Twitter TL for instance and give yourself a dollar for every time you see something about laundry or house cleaning. How much do you have now? From rolling out a new package to introducing more flexible meal plans, they continue to show that the food part of their business is a huge part of it.

Future outlook

The pandemic will not be on forever. With vaccination on the horizon, we are already looking at an end in sight. The question, as with other things the pandemic has accelerated is: what happens after?

Food e-commerce in Nigeria is still in its infancy. It is still a huge opportunity that has not been fully tapped into in this part of the world. Even around the world, many players are still figuring out how to make profits from the food delivery business. There are different ways to approach it. Eden is approaching food e-commerce in a very unique way - a food subscription that is tailored to the user. We are going to see players come in and address it in other unconventional ways. New businesses, especially startups, will move away from the marketplace model of the likes of Jumia. If anything, it is ridiculously complex to execute. Even so in a market like Nigeria.

Remember the infrastructure problem of 2012? Some businesses have risen to solve different parts of it. We have the likes of Paystack solving payments for e-commerce and Gokada solving last-mile logistics. More of these businesses will take interest in the movers of their services. In cases where this is food, they may tend to create products to cater to their users in the category. Gokada has led the way with a marketplace that relies on its existing infrastructure. I see more businesses going this route as well.

Food e-commerce goes beyond food. There are other parts of this booming ecosystem that need to be improved. I see businesses rising to the challenge to fix these underlying problems. We have seen the likes of BuyFood and how they are laser-focused on helping food vendors come online. That is just one example of the many things that are possible.