Crypto Ban in Nigeria: Past, Present and Future of Cryptocurrency

Cryptocurrency has been controversial around the world and even more so in African countries. Two weeks ago, the Central Bank of Nigeria decided to issue a memorandum to financial institutions to stop them from providing payment services to cryptocurrency exchanges. This decision is an unprecedented move and a controversial one at that. Financial institutions could facilitate payments for crypto exchanges before now, but the apex bank had outrightly banned them from holding and transacting in cryptocurrency. However, the February 5 letter seems to proscribe all interactions between our financial system and crypto exchanges. I wrote about the inconsistencies in the CBN decision in this thread.

Before I go further, let me break down the crypto exchange ecosystem as it works and why it is important that they are provided financial services.

Overview of Crypto Exchange Transactions

A cryptocurrency exchange is a marketplace where crypto-assets can be bought and sold. Crypto traders can come into the system and use the tools available to long or short different cryptocurrencies. Beyond futures, there are other forms of trading available to them, including spot trading. In this system, there are a lot of players. However, I will explain those players that are key to this piece - crypto exchanges, traders (buyers and sellers), payment processors, and banks.

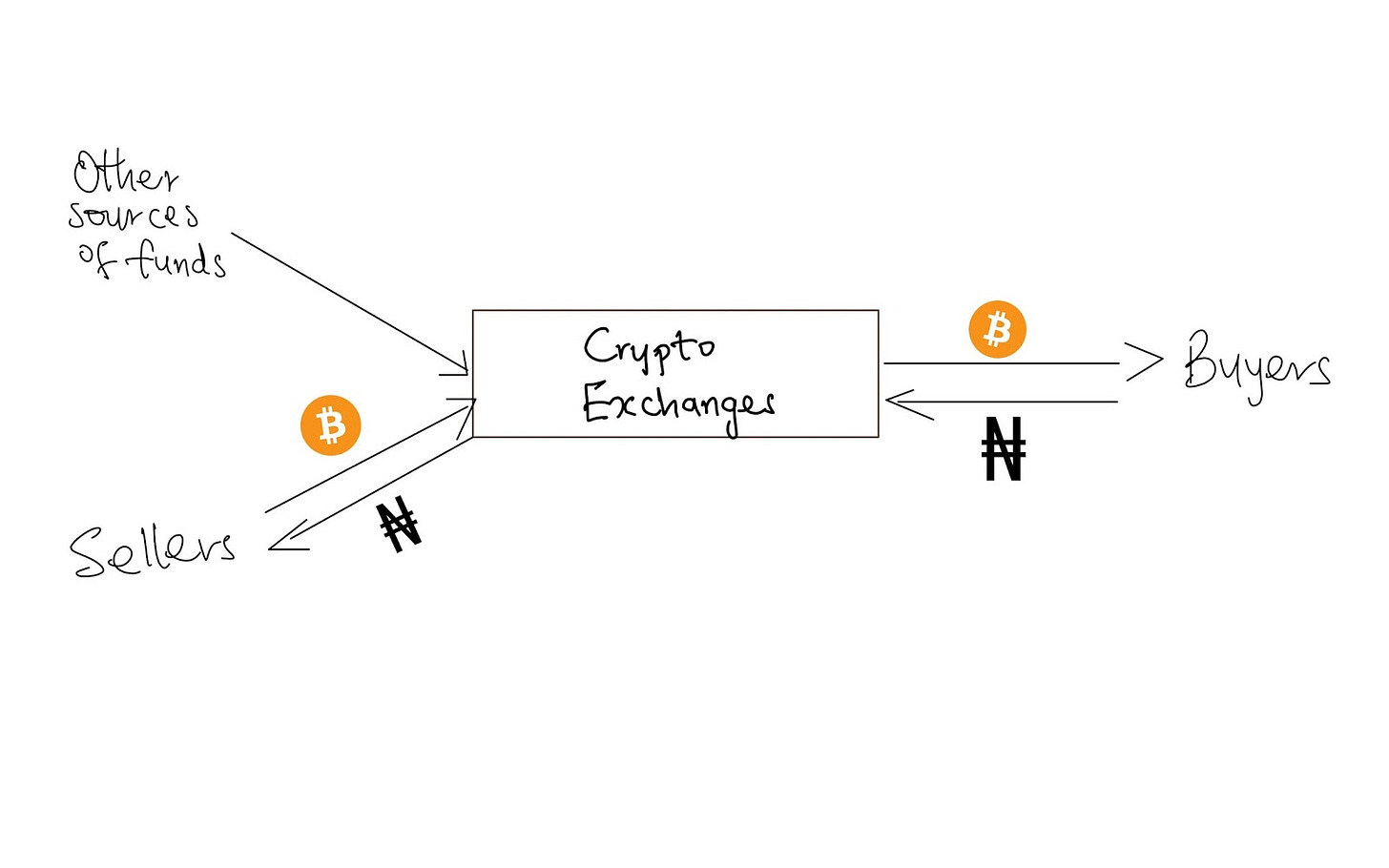

Crypto Exchanges: Crypto exchanges are the mediators of the transactions in the crypto world. They allow for easy movement of the currencies from one part of their world to another. They also facilitate the relationship between fiat and cryptocurrencies. For an average person to get into the crypto game, they need to figure out how to acquire the asset using their existing fiat currency (Naira, USD, or whatever they spend). Other crypto dealers can acquire the assets using other means like mining. Fiat doesn’t just turn into crypto; the cryptocurrency needs to be bought. This instance is where the crypto exchanges come in. Examples of crypto exchanges include Binance, Quidax, etc.

Traders: These are buyers and sellers who are dealing in the crypto economy. Sellers are those who are selling their crypto assets. This may be in exchange for another crypto asset or fiat. For this piece's purpose, we are going to regard sellers as those who are selling in exchange for fiat currencies. Buyers, on the other hand, want to acquire crypto assets. We will assume they want to exchange fiat for crypto. When buyers interact directly with sellers, this is called peer-to-peer exchange (P2P). However, this is not always the case. Sellers can interact with the crypto exchange without ready buyers, and buyers can do the same without willing sellers.

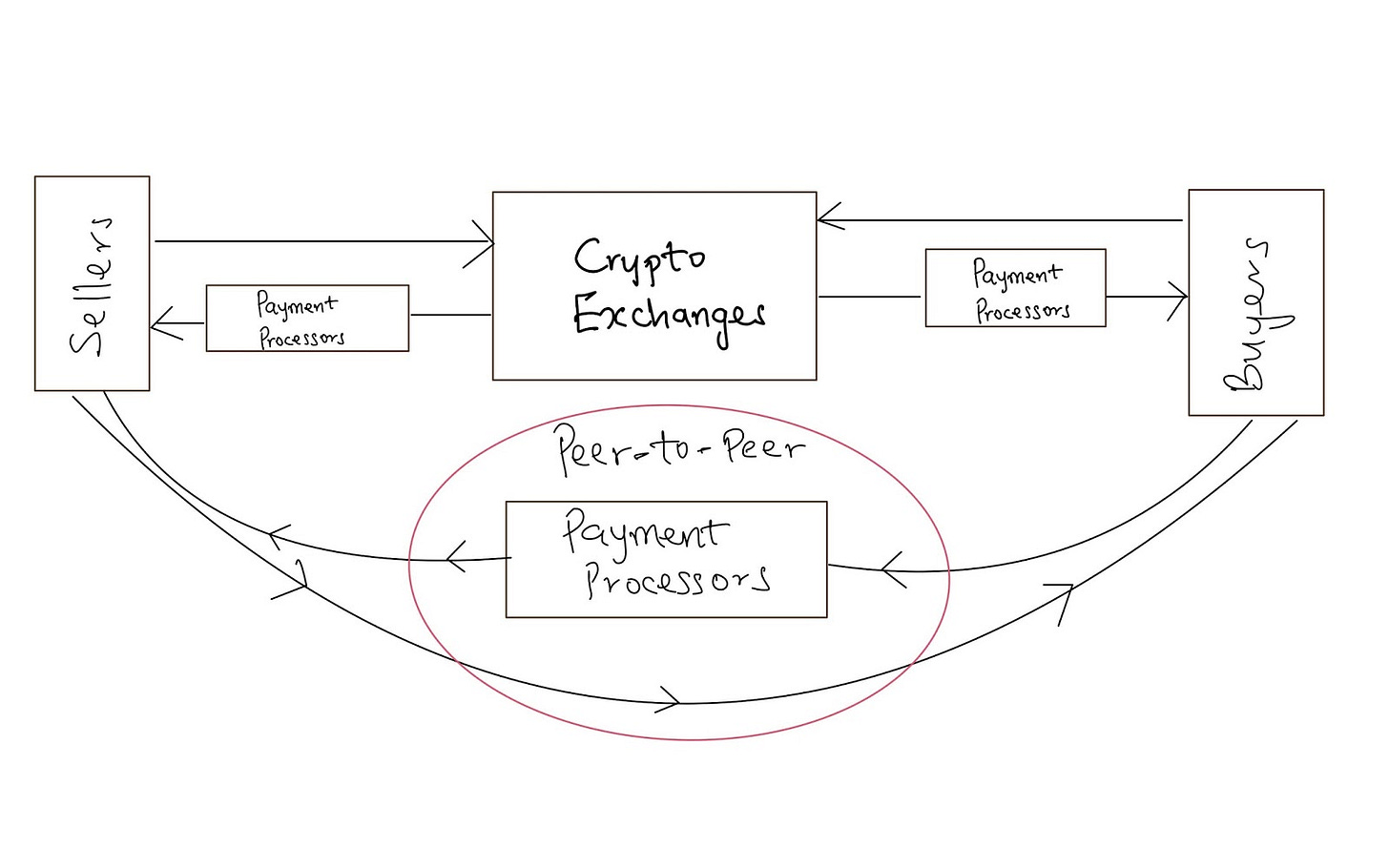

Payment Processors and Banks: Banks are who they are: banks. However, payment processors are slightly different from banks. They manage the credit and debit transactions by moving money from one point to another as needed. They help facilitate the relationship between fiat and crypto in this ecosystem through the help of the banks. Examples of payment processors include Flutterwave, Paystack, etc.

To explain the relationship between all these players, let me set an instance. If a buyer wants to buy 0.004BTC* (crypto) on Binance using ₦100,000 (fiat) from their Wema bank account and wants to interact with the exchange (not a particular seller). They would send the ₦100,000 from their Wema Bank account to Binance through Flutterwave and then be able to use the funds to buy the bitcoin.

Implications of CBN’s actions and workarounds

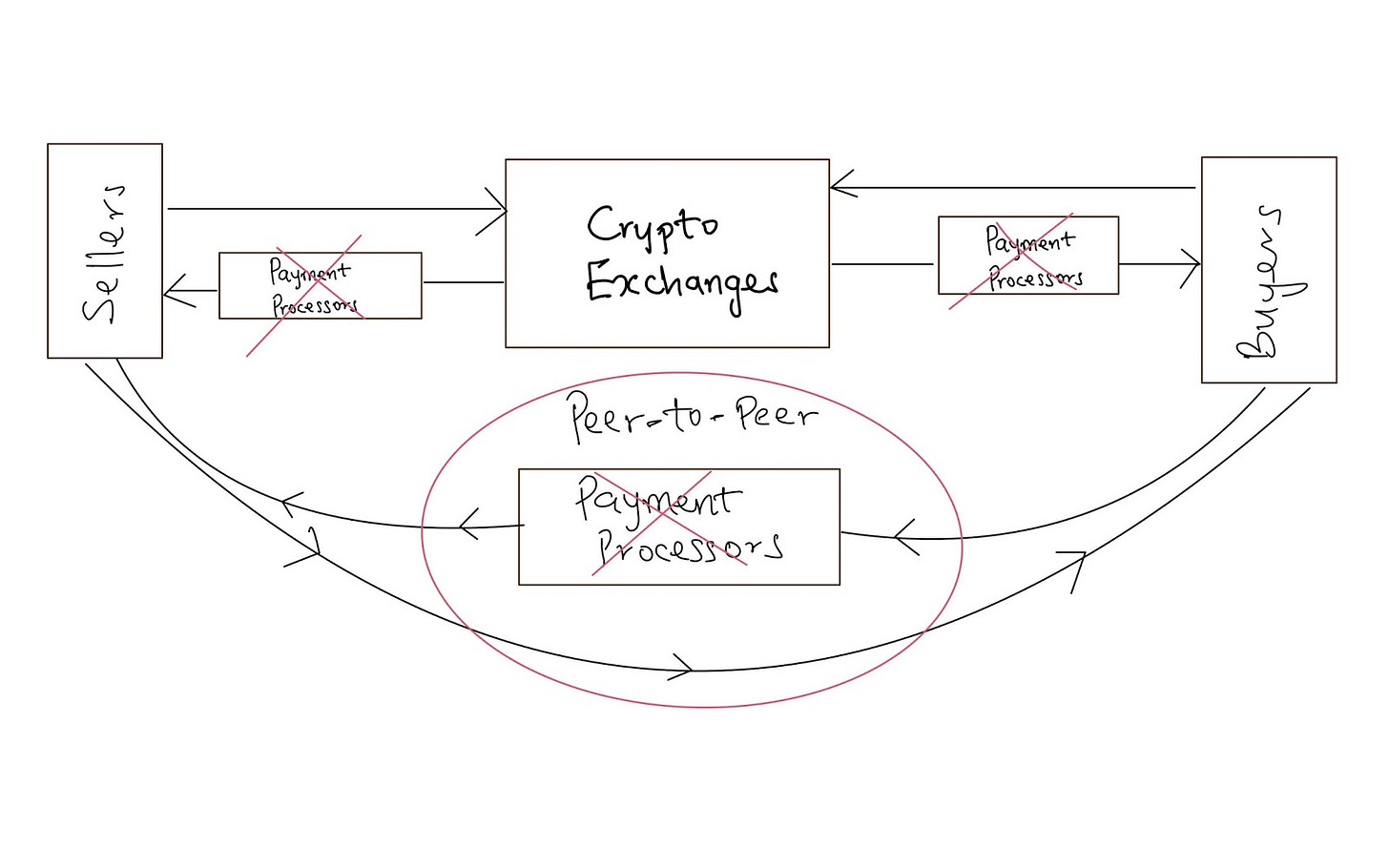

Following the Central Bank of Nigeria’s decision/letter, everyone in the crypto ecosystem has been scrambling for alternatives. It affects all the players differently. In the plainest terms, this directive forbids banks and financial institutions from dealing with crypto exchanges. It simply affects the relationship between fiat (in this case, naira) and cryptocurrencies. Banks and payment processors are no longer able to help users process naira deposits to crypto exchanges and withdrawals from crypto exchanges.

For consumers, they can still trade in cryptocurrencies. They can use their existing crypto assets to continue their trading business. However, moving funds from fiat (naira) to crypto and vice versa has been affected by the directive. They can no longer send money into the crypto exchanges using the usual payment methods like cards or bank transfers. The past week has seen a rise in P2P crypto transactions on various platforms to solve users’ problems. Consumers are leveraging other traders to get in and out of the crypto game. With P2P, you can connect with someone who has crypto value and is willing to sell that in exchange for naira. The seller and trader can connect on any platform, exchange bank, and crypto wallet details, and get the transaction done. This way, the buyer can use the crypto value that he just gained to continue trading on any crypto exchange. This fix cuts out the middlemen - crypto exchanges and payment processors. However, due to the incessant fraud associated with this method, there is an opportunity for crypto exchanges to serve as escrow and provide value for the consumer.

Hence, crypto exchanges have also adopted P2P as their solution to the CBN directive. As a marketplace, exchanges are able to attract both supply (sellers) and demand (buyers). They connect both sides and also serve as the mediator between them. When a seller indicates that they want to sell crypto, the value goes into an escrow within the crypto exchange, and buyers can see their account details to transfer the naira value to the seller. Then, the crypto exchange can release the value to the buyer once payment has been confirmed. As brilliant as this is, its scalability hinges on the amount of crypto in the system that is readily available on the supply side to meet appropriate demand. For smaller crypto platforms, this might pose some issues. With this solution, new money is not entering the system, just a re-circulation of existing value. This fix cuts out the payment processors, and there will be no transaction fees outside of the regular bank transfer fee. However, crypto exchanges can charge escrow fees as this is a value they are currently providing to shield their users from fraud. We see crypto exchanges like Binance use this solution by automating the P2P process without charging any extra fee yet. We are in a learning curve phase where users are still getting used to the new system.

In the payment processor world, it’s tough to make anything out of the current situation. All processors have responded to the direction by shutting down crypto merchants within their services. However, there is a workaround they can be able to provide, albeit expensive and tricky. They can partner with an international payment processor to use their service to help crypto merchants receive money from their customers. However, this will be expensive in terms of charges and limiting for customers that use naira debit cards. Before now, most banks have placed a monthly limit of about $100 - $200 on international transactions. This restriction will hold if a platform is collecting funds using a foreign payment processor. For foreign currency accounts, there is no limit. However, this shrinks the target audience as only a small percentage of Nigerians have domiciliary accounts, as they are called. Also, this workaround is tricky as CBN can directly revoke a payment processor’s license. This fix may be possible for the crypto exchanges where they will work directly with the international payment processor that is not liable to CBN rules.

A trip back to the past

What we are seeing with P2P now is like a time travel to the past. Cryptocurrency started in Nigeria mainly through P2P services. Crypto trading did not pick up until recently. Some years ago, we had vendors like Patricia sell bitcoin to users in exchange for naira. This process was pretty manual as they had users ask for the amount of BTC they want through social platforms like WhatsApp and send the naira equivalent to the vendor’s bank account. Once payment is confirmed, the vendor would use P2P services like Paxful to send the bitcoin from the wallet to the buyer’s wallet. Patricia has since automated some of these services using payment processors and their tech. This directive seems like a trip back to when P2P was done in a very manual way, thereby undercutting payment processors and making the process less efficient.

Future of crypto in Nigeria

As we can see, the CBN directive does not spell doom for the Nigerian crypto market. It’s not even a setback, as trading is still ongoing without many restrictions. What this has affected is access to the crypto market. By cutting the payment processors, the average Nigerian cannot easily get into the game as they would have been able to. The entry barrier is higher, which means you have to really want to be in the crypto world to get in. Unlike before now where you can easily “test the waters”. Restrictions are getting stricter as banks are now closing down individual accounts suspected to be involved in crypto-related transactions. This move is to crack down on P2P as an alternative. As these restrictions go deeper, it will force traders to find less-than-straightforward options. This means people would have to jump through hoops like getting a domiciliary account, funding it with USD (likely through the black market rate), and using the cards with exchanges to be able to trade in crypto. This will indeed not for the fainthearted.

There are two possible outcomes:

CBN keeps cracking down on crypto: Consumers will continue to find alternatives because crypto is here to stay.

CBN backs down: Merchants are able to innovate to make life easier for consumers and advance the crypto game in Nigeria

In either case, I don’t see a future where crypto is dead in Nigeria. People will keep iterating until they can trade in the crypto economy freely.

*Used Paxful’s exchange rate as at 0144hrs WAT 02.15.2021

This is an insightful article!

I enjoyed this. Well done.